new orleans sales tax rate 2020

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is.

. Those district tax rates range from 010 to 100. The Orleans Parish sales tax rate is. Sales and Use Tax Rates Effective October 1 2020.

8 rows TaxFee Description Rate Effective Date Required Filing Tax Form. The Louisiana sales tax rate is currently. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and Oklahoma 444 percent.

Revenue at New Orleans gambling establishments topped 521 million in July 2021 an increase of almost 46 of what the properties brought in during July 2020. Average Sales Tax With Local. Includes the 050 transit county sales and use tax.

This includes the rates on the state county city and special levels. Our Services Youtube San Diego Travel Guide History Lessons Pembroke Pines Realtors Expect These Neighborhoods To Sell Big In. The New Orleans sales tax rate is 0.

New orleans sales tax rate 2020 Sunday March 13 2022 Edit. For tax rates in other cities see Louisiana sales taxes by city and county. New Orleans LA Sales Tax Rate.

You can print a 945 sales tax table here. As of July 1 2018 the state sales tax rate is 445. Revenue Information Bulletin 18-019.

The statewide tax rate is 725. One study shows that per capita sales in. The New Orleans City Council announced the proposed exemption in August saying it would lower the cost of these.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Instead of a 2495 percent sales tax the new ballot initiative will be for a 245 percent tax she said. The Parish sales tax rate is.

There is no applicable city tax or special tax. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1.

Some areas may have more than one district tax in effect. The Orleans sales tax rate is. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information.

New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA is 9450. Revenue Information Bulletin 18-017. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6.

Average local rates rose the most in Illinois changing the states combined ranking from 7 th highest to 6 th highest. The Louisiana state sales tax rate is currently. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

According to the Louisiana Department of Revenue the first 2500 of most consumer purchases from the 445 state sales tax are exempt The Louisiana Sales Tax 2020 holiday will apply to many in-store purchases as well as transactions completed online or by phone. The New Orleans sales tax rate is. The average cumulative sales tax rate in New Orleans Louisiana is 943.

The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. Within New Orleans there are around 51 zip codes with the most populous zip code being 70122. State State Tax Rate Rank Avg.

The definition of a hotel according to Sec. New Orleans has parts of it located within Jefferson Parish and Orleans Parish. The December 2020 total local sales tax rate was also 5500.

Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. For tax rates in other cities see Louisiana sales taxes by city and county. What is the sales tax rate in Orleans Parish.

Orleans NE Sales Tax Rate The current total local sales tax rate in Orleans NE is 5500. Tax rates history 2021xlsx Author. As of July 1 2020.

The 2018 United States Supreme Court decision in South Dakota v. Sellers are required to report and pay the applicable district taxes for their taxable. 4 rows New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA.

Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. The Parish sales tax rate is 5. This is the total of state parish and city sales tax rates.

This is the total of state and parish sales tax rates. The minimum combined 2022 sales tax rate for Orleans California is. State.

Home new rate sales tax. Gail Cole Oct 15 2020. 12212020 75021 AM.

Louisiana has state sales tax of 445 and. Did South Dakota v. The minimum combined 2022 sales tax rate for New Orleans Louisiana is.

Natchitoches LA Sales Tax Rate. What is the sales tax rate in New Orleans Louisiana. Local Tax Rate Combined Rate Rank Max Local Tax Rate.

General Sales and Use Tax. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. Negreet LA Sales Tax Rate.

Louisiana Sales Tax Holiday Details. The sales tax holiday helps residents save a little bit of money on certain purchases.

Alabama Sales Tax Guide For Businesses

Louisiana Sales Tax Small Business Guide Truic

Nevada Sales Tax Guide For Businesses

Louisiana Sales Tax Rates By County

Infographic New Orleans Travel Surges

Sales Tax On Grocery Items Taxjar

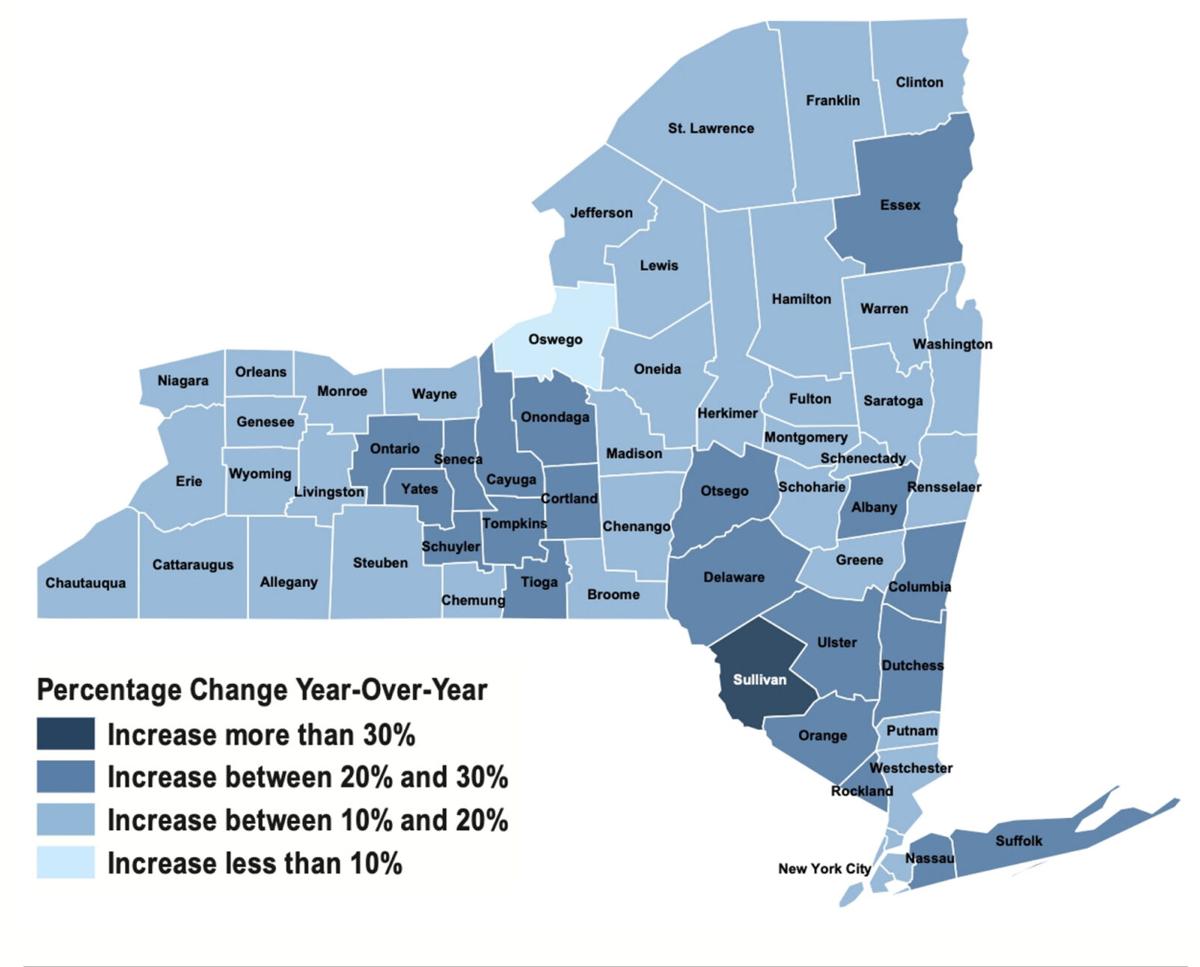

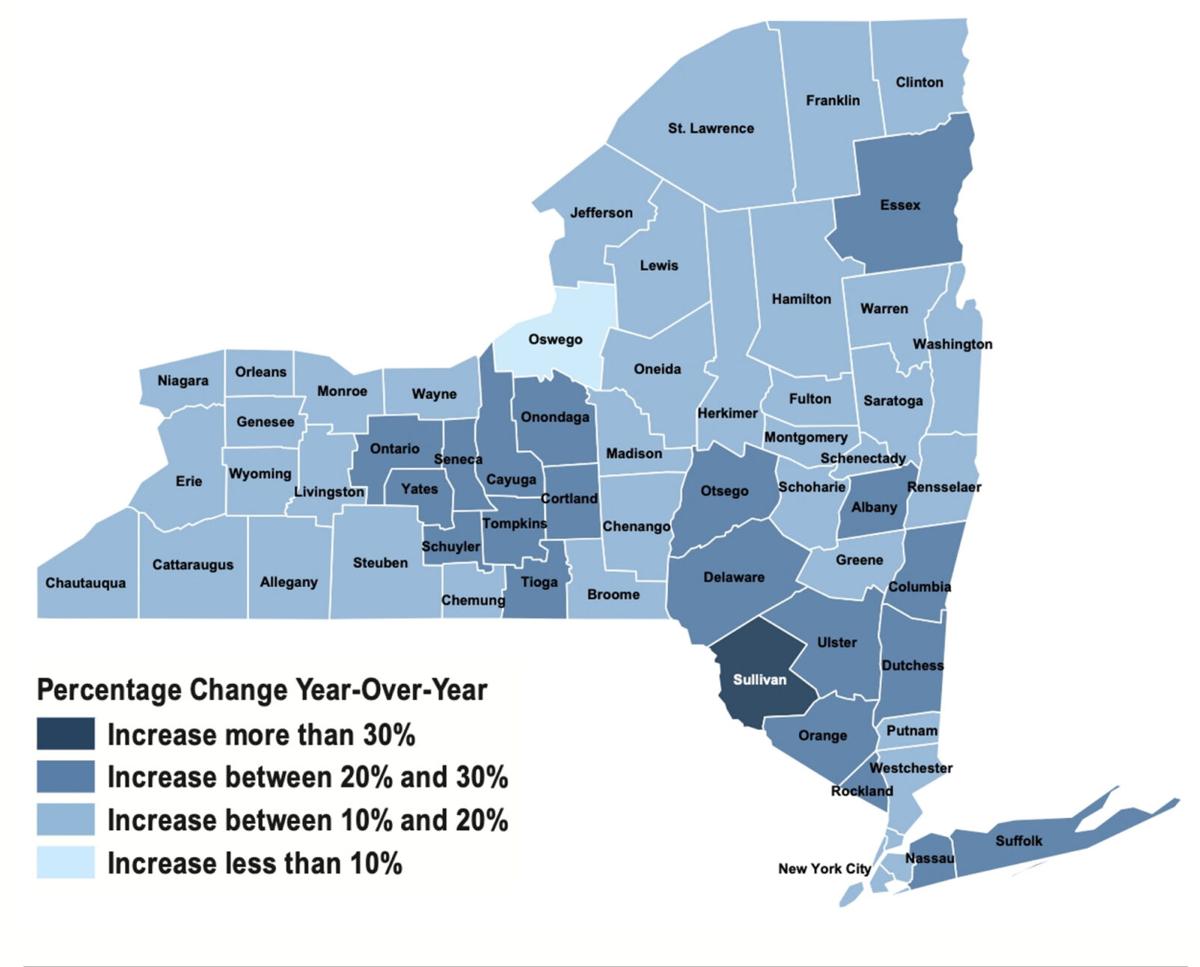

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

State Income Tax Rates Highest Lowest 2021 Changes

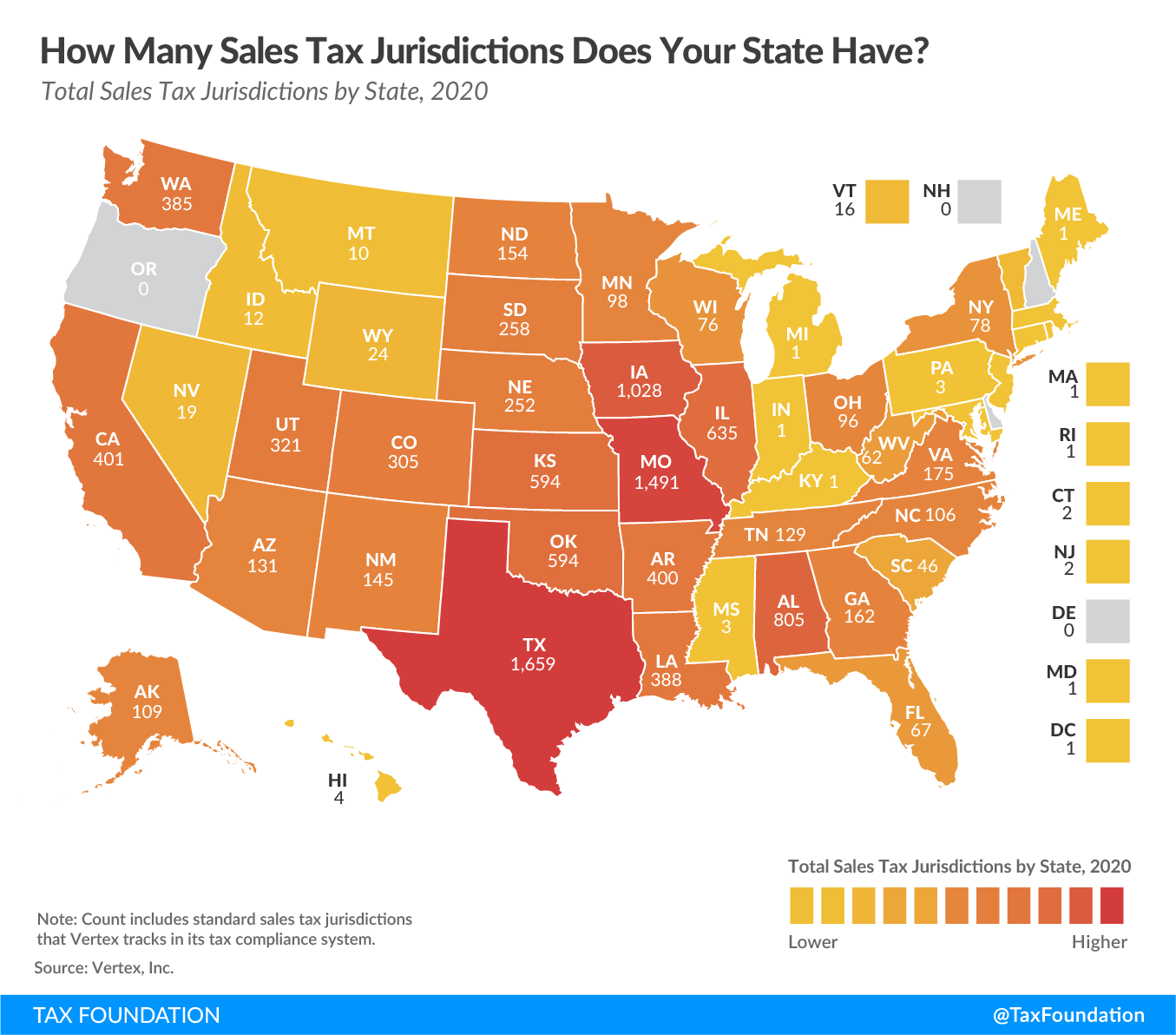

Internet Sales Taxes Tax Foundation

New Orleans Louisiana S Sales Tax Rate Is 9 45

Pennsylvania Sales Tax Guide For Businesses

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

How Property Tax Rates Vary Across And Within Counties Eye On Housing

Internet Sales Taxes Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

Which Cities And States Have The Highest Sales Tax Rates Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com